Non-Discretionary

Investment Consulting

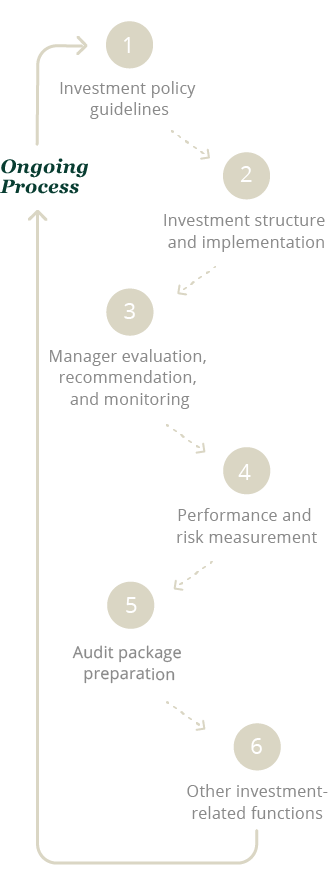

- We provide recommendations for your policy and portfolio.

- Your investment committee reviews and approves our recommendations.

- Your staff manages trade executions and cashflow with our support.

Prime Buchholz is more than an investment advisor. Our sophisticated research operation is a powerhouse that is flexible enough to meet your unique needs and function as an extension of your staff. As a fully integrated partner, we help lighten the burden on your internal staff by providing structure and resources that help them make effective decisions. Our back-office team handles all coordination of investment activity, giving you the time to focus on your goals.

Sustainable, responsible, impact investing–let us be your experienced navigator. We've been helping organizations align their investments with their missions and values for three decades.

Learn MoreWe're a trusted, go-to resource for plan sponsors as they seek to maximize their plan benefits and meet their fiduciary responsibilities with confidence.

Learn MoreDiagnostic Review

Comprehensive assessment of client’s

portfolio and full financial picture