Short-term credit can be a useful tool in client operating pools. In this paper, we review historical performance of the segment, discuss risk factors such as valuations and macro uncertainty, how we seek to mitigate those risks, and our process for building operating pools of capital for clients.

Performance

The short-term credit segment has performed well over a number of periods of market stress, including the sharpest tightening cycle in a generation, a pandemic, and the global financial crisis. The short-term credit segment has kept pace with and, at times, exceeded the returns of the broader bond market. In addition, returns have experienced far less volatility than the broad bond market.

Valuations

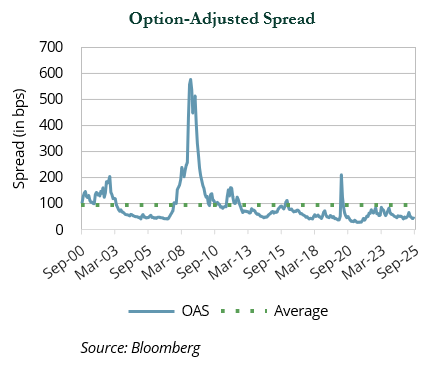

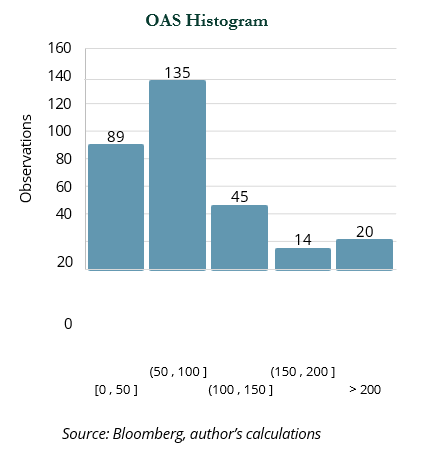

Valuation signals are mixed. As of November 28, spreads were at 45 bps. Over the past 25 years, the average spread was 91 bps but, given a skew in the data, the median was 64 bps.

The histogram below shows the impact of the positive skew in the data. Most observations fall within the 50-100 bps segment and currently spreads are in the second-most populated segment, the 0-50 bps bin.

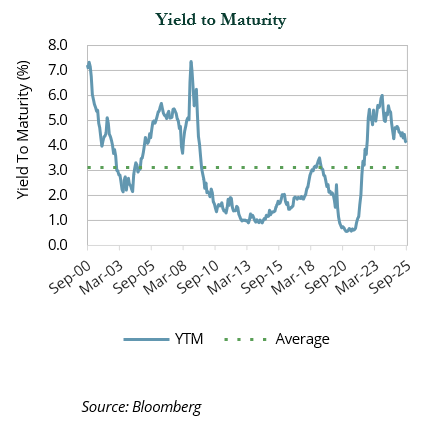

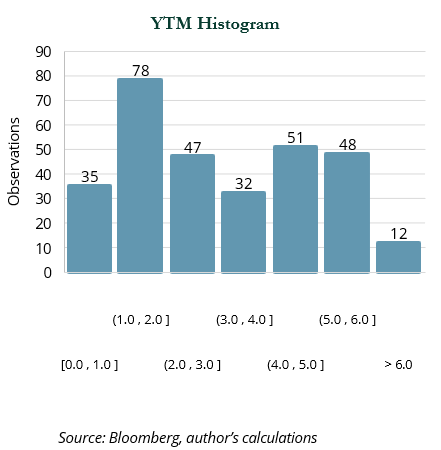

While credit spreads look rich versus historical levels, absolute yields look more attractive. The 4.0% yield to maturity of short-term credit on November 28, 2025, was above the 25-year average of 3.1% and median of 2.8%.

Unlike the spread data, the yield has been higher than the end of November level of 4.0% in 37% of the observations.

In other words, spreads show lean compensation for taking credit risk, but the all-in yield remained competitive due to the persistence of elevated base rates. Given the current investment-grade space credit fundamentals remain sound and default risks remain low, we find recent yields to be attractive.

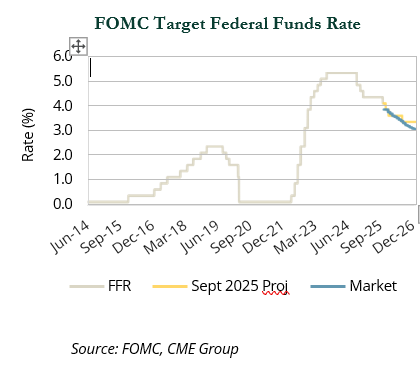

However, we expect yields will change slowly. With the FOMC reducing rates for a third time this year at its December 2025 meeting, to a range of 3.50- 3.75%, the December Summary of Economic Projections (“SEP”) infer one cut in 2026. However, market signals as of December 18, 2025 appear to anticipate two cuts – with a small chance for a third. This dynamic underscores the uncertain path for interest rates.

Against that backdrop, we believe carry is likely to remain the dominant return driver, with limited spread mean-reversion cushion if growth slows or if risk premia back up from very tight levels.

Macro Uncertainties

Several macro threads could pull returns in opposite directions. A re-acceleration in inflation—potentially influenced by tariff dynamics or supply-side stickiness—could slow or interrupt the easing path, supporting front-end yields but pressuring risk assets if policy stays restrictive for longer.

Conversely, continued softening in labor markets would validate additional cuts, lowering reinvestment yields for cash-like assets and putting a premium on locking in carry where appropriate.

Because short credit spreads already sit near rich historical levels, any negative growth surprise or earnings wobble could widen spreads from a tight starting point, making security selection and duration discipline particularly important.

Risk Mitigation

Our risk mitigation approach has several pillars. First and foremost, our diligence process is geared towards identifying investment managers that we believe are best-in-class.

Active managers can diversify both within and away from corporate exposure. As of December 18, the BBB-rated credit tier represents 36% of the Bloomberg U.S. Credit 1-3 Yr Index, up from approximately 26% in 2004. While short-term credit has been durable and the risk of default is low, we feel that active managers with strong research capabilities can evaluate this segment to find opportunities and avoid credit selection mistakes.

Also, active managers can invest in a broad universe of fixed income instruments, such as Agency MBS and securitized credit (ABS and, in some cases, CMBS). We feel we have access to talented managers who have been good stewards of capital and have displayed an ability to appropriately navigate uncertainty.

The second pillar is providing guidance while crafting an investment policy statement (“IPS”) with clients to set expectations and, more importantly, guardrails. From there, we work with managers to develop investment management agreements that align with the principles of the IPS, including credit quality guidelines, allowed and prohibited investments, issuer limits, duration band, and other relevant factors.

Constructing Durable Operating Pools

We align liquidity needs with the objective for risk-controlled yield capture across three time horizon tiers, emphasizing simplicity, transparency, and the ability to adapt to changing conditions.

Across tiers, we seek to target the highest sustainable yield per unit of risk, not the highest headline yield.

Practically, that means: (i) prioritizing liquidity matching to avoid the need to sell into volatility, (ii) favoring issuer quality and diversification over a reach for yield, (iii) using duration selectively to counter reinvestment risk during an easing cycle, and (iv) keeping implementation costs low and structures simple.

We calibrate allocations to each tier based on individualized cash-flow mapping, governance, and tolerance for mark-to-market variability.

The result is an operating pool that we believe should be able to weather monetary policy and/or market shifts, maintain access to liquidity, and systematically capture carry as reinvestment rates trend lower.

Tier 1 – Liquid Cash (≤ 6 months need):

Funds likely to be spent in the near term are held in Treasuries, government money market, or even bank deposits. The objective is capital preservation and daily liquidity.

As the Fed eases, yields in this tier will reset lower quickly, which argues for maintaining this tier strictly for true liquidity to avoid unnecessary reinvestment drag.

Tier 2 – Short-Term Reserves (≈ 12–18 months horizon):

For dollars not immediately needed but still tied to operating timelines, we introduce measured credit and modest duration risk through ultrashort or low- duration strategies, sized to a client’s tolerance. In today’s environment of tight spreads but reasonable all-in yields, this tier emphasizes high-quality issuers, diversified sector exposure, and minimal structural complexity.

The goal is to lock in carry beyond overnight rates while keeping mark-to-market volatility contained and preserving the ability to rebalance as rates move.

Tier 3 – Longer-Term Reserves (≥ 18 months horizon):

For balances with more runway, low-duration strategies are the default option, with selective use of intermediate or core bond exposures where cash-flow predictability and risk tolerance allow. This tier is designed to secure a larger opportunity set of investment options while keeping interest-rate exposure commensurate with the operating mandate.

Given rich short-credit spreads, extending modestly in duration—rather than reaching materially down in credit—can be a more resilient way to preserve yield as base rates fall.

Summary

Short-dated credit remains useful but must be owned with clear eyes: spreads are expensive, absolute yields are still serviceable, and the monetary policy path is easing but uncertain.

A tiered operating pool converts those facts into action by preserving immediate liquidity, extending duration thoughtfully to protect against reinvestment drag, and avoiding unnecessary credit- beta at a rich point in the cycle.

Our goal is straightforward: maximize dependable yield while minimizing interest rate and credit surprises, customized to the reality of each client’s operating needs.