As we enter 2026, there is reason for cautious optimism, even as uncertainty remains elevated. Markets continued to advance through 2025 despite persistent headwinds, including geopolitical tensions, inflation concerns, and shifting policy dynamics. While headline indices masked growing dispersion beneath the surface, investors were challenged to balance participation in upside with heightened sensitivity to risk.

In our 2026 Investment Outlook, we highlight the key themes shaping our asset class assumptions and the investment landscape entering 2026.

Macroeconomic Outlook

The macroeconomic backdrop entering 2026 points to continued expansion, with outcomes increasingly dependent on where growth is sourced and how risks compound. In the U.S., baseline growth appears anchored near trend—roughly 2%—supported by fiscal stimulus through the One Big Beautiful Bill Act (OBBA), robust business investment in AI, and improving productivity. Growth could run higher if productivity gains persist, but remains vulnerable to a consumer spending pullback if labor markets soften.

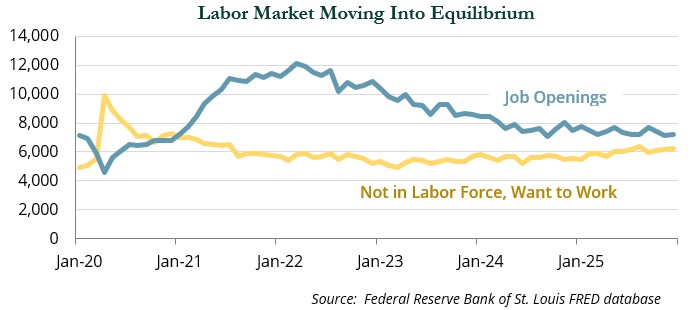

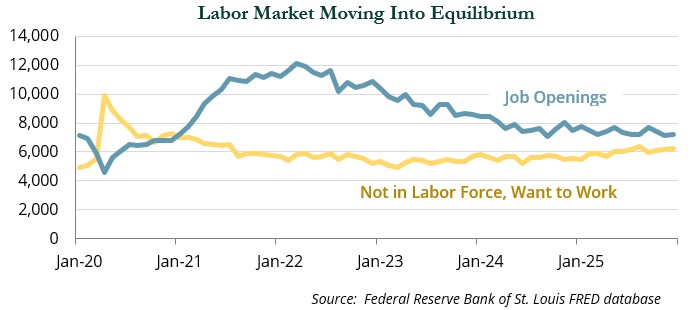

AI investment has become a meaningful contributor to GDP growth and may continue to offset weakness in consumer demand. Productivity has improved, and labor supply–demand dynamics appear to be stabilizing, though recent softening bears watching. If labor markets move materially past equilibrium, consumer spending could weaken, particularly among lower-income households. The economy remains K-shaped, with high-income earners relatively resilient, making aggregate consumption increasingly reliant on the upper end of the income distribution.

Inflation risks remain elevated. Not only is there ongoing tariff uncertainty, but deficit-to-GDP levels are high outside of recessionary or wartime periods. When there is less slack in the economy, deficits can become inflationary. These dynamics further complicate the disinflation outlook. While the Fed maintains a cautious stance with an easing bias following the late-2025 rate cuts, the policy path remains uncertain. Tensions between the administration’s push for lower rates and the Fed’s inflation mandate add to policy uncertainty and the risk of renewed rate volatility.

Geopolitical risks remain heightened. Ongoing conflict in Ukraine, a fragile Middle East ceasefire, political instability in Venezuela, and unpredictable geopolitical rhetoric continue to influence energy markets, global trade, and investor sentiment.

Overall, the macro environment entering 2026 is supportive but conditional: growth persists, policy is directionally accommodative but increasingly complex, and inflation and geopolitical risks constrain the margin for error. Realized outcomes are likely to be shaped more by dispersion across income cohorts, policy outcomes, and geopolitical exposures than by a single macro narrative.

Public Equity

Public equities enter 2026 with dispersion beneath headline indices and concentration still setting the tone. The dominant themes are a widening gap between index-level results and underlying market breadth, factor regimes that can remain detached from fundamentals, and the reality that benchmark rules, screens, and weightings meaningfully shape what investors experience as “equity beta.”

AI remains a cross-sector expectations engine, influencing correlations and valuation frameworks well beyond technology, and making outcomes more sensitive to timing and durability assumptions. Outside the U.S., developed markets saw similar dynamics but with varying drivers. The prospect of new government spending sparked long-dormant investor sentiment.

Emerging markets (EM) remain dominated by country-level dispersion, governance credibility, and sector composition rather than a single EM narrative. Overall, 2026 looks less like a single-market call and more like an environment where concentration, factor leadership, and implementation choices drive outcomes.

What We’re Watching

- Concentration remains central, with a small set of mega cap contributors tied to the AI theme disproportionately driving index returns and relative performance for active managers, as well as volatility and drawdown behavior.

- Valuations for U.S. large cap equities, particularly the mega caps, remain elevated relative to history even as fundamentals remain strong. Small and mid-cap valuations are slightly below long-term averages.

- Down-cap performance reflects a market rebound since April, coinciding with outsized gains for non-earning companies; high beta and momentum leadership can persist, then reverse sharply when conditions tighten.

- Non-U.S. equities continue to offer attractive valuations relative to the U.S. despite the recent rally. Likewise, the U.S. dollar remains overvalued relative to other major, foreign currencies.

- Europe’s pivot away from austerity has the potential to boost economic growth and corporate earnings in the coming years.

- EM is home to critical players in the global AI ecosystem. AI-driven demand provides a constructive backdrop underpinned by attractive relative valuations and earnings momentum.

Fixed Income

Fixed income faces crosswinds from monetary policy uncertainty, inflation risks, and stretched valuations. Near-term correlations have improved, which suggests that Treasuries can offer diversification benefits. While diversification benefits have improved, dispersion within credit is widening, raising the importance of security selection and exposure positioning.

What We’re Watching

- Fiscal policy accommodation is set to rise as OBBA takes effect, and although the Fed reduced rates in late 2025, the extent of further policy easing remains uncertain amid hawkish views on inflation and pending leadership changes.

- Rate volatility, which moderated late in 2025, may increase due to uncertainty around Fed policy and independence. The term premium may continue to reassert itself at the very long end of the curve if concerns about fiscal discipline grow.

- Credit risk is concentrated in lower-quality pockets with refinancing needs. AI-related borrowing is a supply theme for investment grade, influencing spreads, liquidity, and index concentration as funding needs scale.

- On a percentile basis, U.S. interest rates appear to be more attractive than credit spreads. However, in a stable economy, the additional carry available in credit may drive outperformance, as spreads can remain tight for extended periods.

Flexible Capital/Private Credit

Hedge funds enter 2026 fully invested, with leverage near peak levels and hopeful that strong 2025 alpha can persist. Generally, managers continue to expect a broadening opportunity set in global equities, building on unexpected 2025 winners such as European defense, biotechnology, and telecom/satellite, while seeking contrarian and event-driven opportunities in housing, healthcare, and software. Conviction around AI-related companies remains high across sectors, with dispersion among winners and losers creating long and short opportunities.

At the same time, concern is growing around hyperscaler spending that potential revenue growth may not justify the increased spending and use of debt. Credit markets are generally healthy, with tight spreads and abundant capital for creditworthy borrowers, further supporting M&A activity, which we expect to be a growing theme in 2026. Stress persists at the margins, but credit managers continue to have a high hurdle for investments in distressed situations, particularly following fraud-driven collapses of Tricolor and First Brands. Private credit continues to be a growth area, but investor scrutiny of performance and liquidity has intensified.

What We’re Watching

- The K-shaped consumer dynamic is also evident in credit markets. Capital remains readily available for IG-rated and BB/B-rated high yield borrowers, while CCC-rated borrowers face looming maturities and elevated borrowing costs. Headline default rates remain modest (2-3%), but pockets of stress (cable/media, chemicals, housing-related industries) are creating opportunities for hedge funds.

- Lower rates and tighter spreads necessitate greater selectivity in credit, and we expect this to lead to increased dispersion in returns.

- Tariff uncertainty delayed the M&A boom expected under the Trump administration, but activity picked up late in 2025 and is expected to continue in 2026, driven by lower borrowing costs and relaxed antitrust enforcement. Elevated M&A broadens opportunities for multi-strategy and event-driven managers and supports a more robust direct lending market.

- Direct lending capital growth slowed modestly in 2025, but there is considerable dry powder. New leveraged buyout (LBO) activity would provide a strong tailwind for deployment and potentially increase spread potential after years of refinancing activity and tighter spreads in private credit.

- However, competition is fierce, with large private lenders competing against the public syndicated loan market, while others are dipping into smaller companies to put capital to work. An uptick in the use of paid-in-kind (PIK) interest is a warning that credit standards and quality in private lending are deteriorating.

- The AI theme will continue to require deep quality research as it spreads across sectors, with dispersion between beneficiaries and those being disrupted, creating both long and short opportunities.

- Long/short equity remains attractive after a strong 2025 as active stock-picking and strict risk management continue to gain importance. With markets near all-time highs, company fundamentals are more in focus as individual stock behaviors diverge, creating opportunities for tactical value-add through active exposure and risk management.

Real Assets – Real Estate

After a multi-year downturn, real estate markets appear to have reached their cyclical floor. Green shoots are emerging, with resilient demand for space across many sectors—even beleaguered office markets in New York City and the Bay Area. New supply has plunged sharply and access to credit has improved, setting the stage for strong earnings and net operating income growth in 2026-27. However, recovery is likely to be uneven, making asset selection critical across sectors and markets.

What We’re Watching

Assets with legacy or broken capital structures continue to face a reckoning, creating opportunity to acquire high-quality assets with strong earnings growth across sectors and markets.

- Downturns and periods of capital scarcity are often the best time to put capital to work in the cyclical asset class, particularly with strategies that have deep domain and market expertise.

- Public real estate markets, which tend to lead private real estate in both up and down cycles, traded higher in 2025 and may offer an early signal for private market recovery.

Real Assets – Infrastructure

A confluence of pre-AI tailwinds continues to benefit incumbent assets as well as greenfield developments across infrastructure sectors. The AI buildout has created a “wave on top of a wave” dynamic in digital infrastructure, power and grid infrastructure—both clean and natural gas—and, to a lesser degree, water.

What We’re Watching

- Circular transactions amongst AI leaders, which have a wide dispersion of credit profiles, are creating bubble concerns and frothy conditions in certain segments and sub-markets.

- Asset-level risk/return profiles vary widely, by quality, market, counterparty, and by workload—particularly in digital infrastructure and power where AI training demands differ materially from non-AI related cloud and connectivity uses.

- Disciplined, experienced managers armed with a limited pool of discretionary capital are positioned to capture tailwinds across the asset class (or specific sectors) while preserving downside protection.

Real Assets – Energy

While crude markets face continued downward pressure from ongoing supply risks in 2026, the sector remains capital-constrained, with demand expected to continue to grow steadily over the long term. Natural gas benefits from multiple secular tailwinds, including liquified natural gas exports, growth in power demand, and coal plant retirements.

What We’re Watching

- Despite strong returns and distributions from the sector over the last several years, private capital fundraising has remained anemic.

- Family offices, private businesses, public companies and ABS financing have partially filled the void left by private equity. However, the lack of dry powder creates opportunities for experienced well-capitalized PE energy teams with cycle-tested expertise.

Private Equity

Private equity enters 2026 with a materially improved operating environment relative to the prior three years. Credit markets remain functioning, public equities continue to support risk appetite, and managers anticipate a gradual reopening of both M&A and IPO exit pathways as previously constrained exit markets begin to thaw.

However, the key question is not whether conditions have improved, but the pace and breadth of normalization. The backlog of aging PE-backed assets is substantial with nearly 12,900 companies as of third quarter 2025, 30% of which have been held for seven years or longer. This implies that liquidity normalization will be a multi-year process, even if 2026 marks a meaningful step forward. While exit value has rebounded sharply, exit volume—the true measure of broad market clearing—has improved only modestly, underscoring the need for greater mid-market activity beyond large and mega-cap deals.

The current environment suggests 2026 will be a transition year with returns driven by underwriting discipline and operational execution rather than the tailwinds of cheap leverage and broad multiple expansion. In this environment, managers with repeatable value-creation capabilities, financing creativity, and credible exit planning should be advantaged.

- Exit value rebounded sharply in 2025 ($621.7 billion through October versus $379.6 billion for full-year 2024), but exit count improved only marginally (1,300 vs. 1,369), indicating that large deals are driving aggregate dollars while broad mid-market liquidity remains constrained.

- Strategic M&A activity has improved but buyers remain selective, requiring sponsors to develop credible exit plans aligned to realistic buyer sets and financing conditions over the next 12-36 months.

- Bid-ask spread normalization in the mid-market remains a critical catalyst for deal volume recovery beyond the highest-quality assets.

- Continuation vehicles are representing a more meaningful exit avenue for managers with 133 GP-led exits globally through October 2025 ($80.1 billion estimated value, $430 million median), and continued growth expected as LP scrutiny of GP conflicts increases.

- For venture, the “growth at all costs” mindset has shifted toward capital efficiency, pushing many companies that raised at inflated valuations to face flat or down rounds as market valuations normalize.

Concluding Thoughts

The 2026 environment underscores that outcomes are increasingly driven by how portfolios are constructed, rather than by broad market direction. Elevated valuations, concentrated exposures, and uneven liquidity conditions reduce the margin for error, making selectivity and portfolio risk management more important than high-conviction directional views.

For investors, this places a premium on portfolio mechanics and flexibility—understanding benchmark and factor exposures, identifying liquidity requirements, rebalancing deliberately and taking profits prudently. Portfolios designed to adapt as conditions evolve, rather than rely on static assumptions, are better positioned in a market that remains supportive, but conditional.

We look forward to partnering with you to keep your portfolios aligned with your long-term goals and to navigate changes in the market environment together.

Indices referenced are unmanaged and cannot be invested in directly. Index returns do not reflect any investment management fees or transaction expenses. This report was prepared by Prime Buchholz LLC (Prime Buchholz). The report is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. Information obtained from third-party sources is believed to be reliable, however, the accuracy of the data is not guaranteed and may not have been independently verified. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. All commentary contained within is the opinion of Prime Buchholz and intended solely for our clients. Some statements in this report that are not historical facts are forward-looking statements based on current expectations of future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, it shall not have any liability or responsibility for injury or damages arising in connection therewith.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and / or Russell ratings or underlying data and no party may rely on any Russell Indexes and / or Russell ratings and / or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Past performance is not an indication of future results.

© 2026 Prime Buchholz LLC