By Valerie Berezin, CPA and Lisa Sebesta, CFA

Principals/Consultants

In recent years, a growing number of institutional investors have sought to align their investment strategies with the communities they serve. This growing interest in place-based investing (PBI)—the deployment of capital to achieve both financial returns and positive social or environmental outcomes in a specific geography—reflects a shift in how organizations view the potential for their role in local communities beyond just grantmaking.

For many organizations, there remains a misconception that place-based investing is only feasible for those with large pools of assets. However, it is increasingly clear that even institutions with smaller asset bases can implement successful PBI strategies. The expansion of impact investing tools, the rise of specialized fund managers, and the increasing availability of intermediaries like community development financial institutions (CDFIs) mean that institutions of all sizes can participate in local investing.

In this investment perspective, we explore the current landscape of place-based investing, outline some of the key challenges, and provide a practical guide to implementing PBI across various institutional contexts.

Current Environment

The rapid increase in interest in place-based investing is largely driven by the rising demand for mission-aligned investment (MAI) strategies. Some broad trends include:

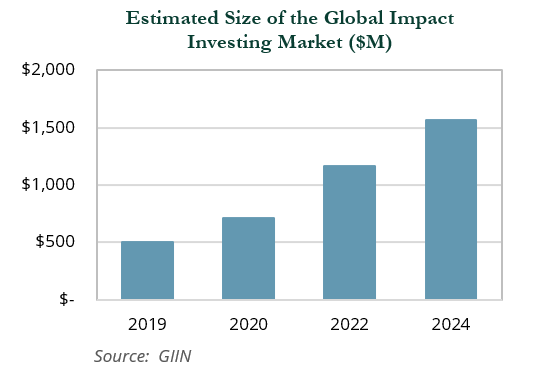

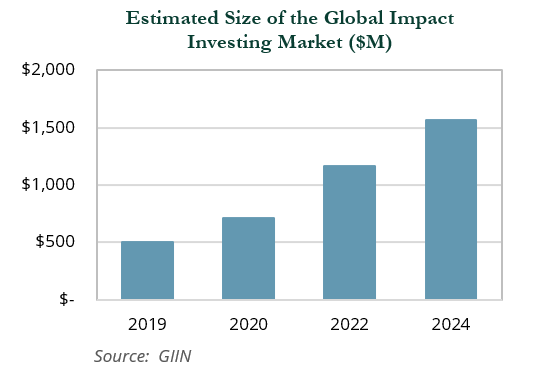

- Growth in Sustainable and Impact Investing –Investing with an eye toward mission alignment has moved into the mainstream. According to the Global Impact Investing Network (GIIN), the impact investing market reached over $1 trillion globally in 2023. This growth in MAI is fueling interest in place-based opportunities.

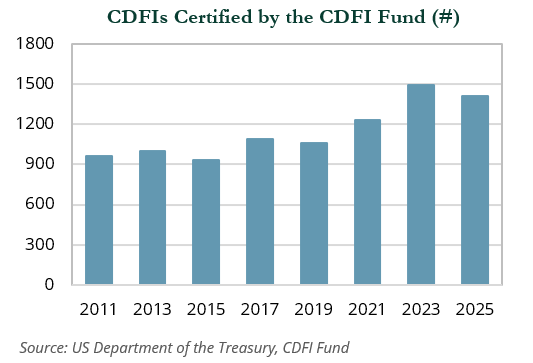

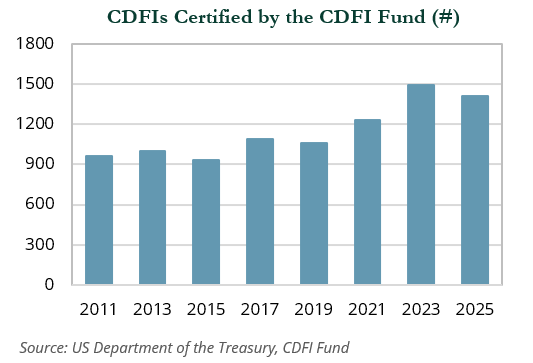

- Increasing Role of Intermediaries – Institutions that may not have the capacity to underwrite direct local investments are now able to access place-based opportunities through intermediaries like CDFIs, regional loan funds, and other mission-aligned investment vehicles. These intermediaries offer institutions the ability to direct capital to underserved communities, mitigating some of the risk and complexity of direct investments.

- Customization of Investment Products – Investment managers have developed products that allow institutions to direct funds to specific geographies while still maintaining a diversified, risk-managed portfolio. Examples include bond funds or impact-focused fixed income products, which allow investors to participate in place-based strategies while maintaining liquidity and meeting their financial goals.

At Prime Buchholz, we’ve observed a growing PBI interest among our nonprofit clients, particularly foundations and higher education institutions. Many also overlay a social and racial equity lens with the intention of building prosperity among all members of their communities. These organizations see PBI as a way to reinforce their mission while addressing pressing local needs. We’ve worked with clients to incorporate place-based opportunities into their portfolios through intermediaries, as well as direct investments, in affordable housing, community development, and local enterprises. Our role is to guide them through the process, ensuring that the investments align with their financial objectives and risk tolerance.

Challenges in Place-Based Investing

Despite the growing interest in place-based investing, there are several barriers that institutions must address to implement a successful strategy. These challenges include the following:

Perception of Increased Risk

Many organizations are hesitant to allocate significant portions of their portfolios to place-based investments because of the perceived risk. Concerns about liquidity, volatility, and potential underperformance compared to market-rate investments can be obstacles.

Donor and Stakeholder Resistance

For donor supported organizations like community foundations, some donors may be uninterested in place-based strategies. Ensuring that donor interests align with the investment strategy is crucial to maintaining support.

Limited Internal Capacity

Many institutions lack the internal resources or expertise to conduct due diligence on local investment opportunities. This can make it difficult to source, vet, and manage investments without external support.

Liquidity Constraints

Place-based investments, particularly in areas like affordable housing or economic development, often involve illiquid assets. Institutions need to carefully balance their liquidity needs with the illiquidity inherent in many local investment opportunities.

Governance and Alignment

Ensuring that investment committees and governing bodies are aligned on place-based strategies can be a challenge. Committee members may have differing views on risk, return expectations, and mission alignment, which can create hurdles in approving investments.

Implementation

To successfully implement a place-based investing strategy, institutions need a clear framework that addresses governance, idea sourcing, portfolio construction, and ongoing monitoring and management. Here’s a breakdown of the steps involved:

Governance and Policy Development

Before making PBIs, institutions must develop a governance structure that aligns with their mission and financial objectives. This starts with the creation or revision of an investment policy statement (IPS) to include place-based investing principles.

- Define Return Expectations – Clearly state the expected financial and social returns. Ensure that the board or investment committee understands the balance between these two goals.

- Risk Tolerance and Liquidity – Define how much of the portfolio can be allocated to illiquid investments and ensure the investment committee agrees on the level of risk acceptable for place-based strategies.

- Consider Carveouts – Some clients, notably community foundations, may choose to create a separate pool to support local initiatives and place-based investments. This type of pool usually has its own risk and return expectations, which should be clearly defined.

Sourcing Investment Opportunities

Investible opportunities that align with a local investment program can be difficult to find. We recommend casting a wide net and being open to unconventional sources of ideas.

- Leverage Intermediaries – Intermediaries like CDFIs, community loan funds, or regional development banks can help institutions deploy capital locally while reducing the burden of due diligence and risk management.

- Engage Various Stakeholders – Community members, donors, and program staff often are the best source for place-based investment ideas. Grant recipients may also be eligible for financial investment. For community foundations or organizations with donor-advised funds (DAFs), engaging donors in deal sourcing can help build support for a place-based pool. Institutions may offer donors the option to “opt-in” to specific place-based opportunities.

- Engage Outside Networks – Specialty service providers have cropped up to help investors with bespoke impact investment mandates that are often “impact first”, considering financial return secondary. These advisors can help source direct investments in a specific geographic region or tap into regional and local networks for additional idea generation.

Portfolio Construction

Building a place-based investment portfolio requires balancing local impact with diversification and risk management. This makes it challenging for larger endowments to invest all their assets in local initiatives and meet their risk and liquidity requirements. We support our clients who desire to invest hyper-locally, but also encourage the use of regional and national investments that can complement their PBI goals.

- National Investment Products with Local Focus – Consider investment vehicles that allow national exposure but with the flexibility to direct capital to specific geographies. For instance, there are fixed-income products that offer the ability to target specific geographies.

- Direct Local Investments – For institutions with the capacity, direct investments in affordable housing, small businesses, or local infrastructure projects can have a significant impact. However, these should be balanced with more liquid, traditional investments to maintain portfolio flexibility

- Cash Counts – Carving out a portion of an organization’s cash to place at a local credit union may be a tool to keep assets in the community. Additionally, there are platforms that enable organizations to deposit funds at scale covering a range of social justice and climate change initiatives, with the ability to focus on a specific geography.

Monitoring and Rebalancing

Place-based investments require ongoing oversight to ensure that they meet both financial and impact objectives.

- Performance Monitoring – Institutions should work with their advisors to regularly review the performance of their place-based investments, adjusting the strategy as needed to ensure alignment with broader portfolio goals.

- Mission Alignment Review – Regularly revisit the mission alignment of these investments. Over time, an institution’s focus may shift, requiring adjustments to the types of investments being made.

Conclusion

Place-based investing offers institutional investors a powerful way to align their financial assets with their mission, creating tangible benefits for the communities they serve. As the industry continues to evolve, with growing interest in ESG and impact investing, institutions of all sizes are finding that they can participate in place-based strategies. However, challenges like risk perception, liquidity constraints, and internal capacity must be carefully managed to ensure success.

Prime Buchholz has helped many institutions navigate these challenges by providing tailored investment strategies that align with their unique missions and financial goals. Whether through sourcing and screening local investment opportunities, building diversified portfolios, or providing ongoing governance and risk management support, we offer the tools and expertise necessary to implement successful place-based investing strategies.

Ultimately, by adopting place-based investing, institutions can generate meaningful financial returns while making a lasting impact in the communities they care about. As this approach continues to grow in popularity, now is the time for organizations to explore how PBI can fit into their broader investment strategies.

All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Some statements in this report that are not historical facts are forward-looking statements based on current expectations of future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results. © 2025 Prime Buchholz LLC