Sarah Todd

Principal/Associate Director, Research – Equity

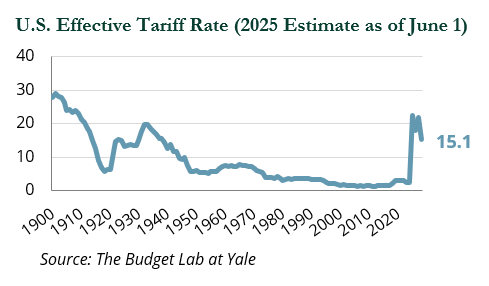

Trump 2.0 trade policy is significantly broader in scope and more aggressive than anticipated and disproportionately affects emerging and developing economies.

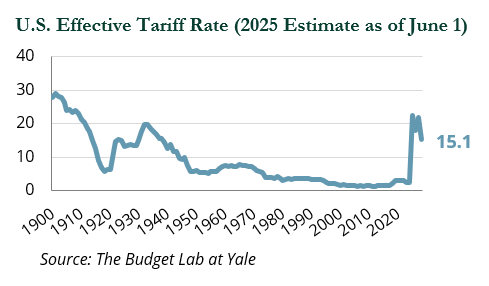

This marked shift in U.S. trade policy adds a new layer of uncertainty to an already fragile global economic environment. Though some near-term de-escalation has occurred—most notably a 90-day pause on reciprocal tariffs between the U.S. and China—uncertainty remains high and the estimated U.S. effective tariff rate still sits at a level not seen since 1937, assuming no change to import share from targeted countries.

Markets have been turbulent as investors question whether tariffs will impede global growth and drive inflation; particularly within emerging economies, where growth prospects relative to developed economies have long been a component of the value proposition.

Against this backdrop, the resilience of emerging markets (EM) may come as a surprise. While such economies are often perceived as most vulnerable to external shocks, many have expanded trade relations and built more diversified and domestically rooted growth engines in recent years.

In this investment perspective, we explore the structural trends within EMs that could serve as offsets to the mounting pressure of global tariffs.

Diversification of Trade Partnerships

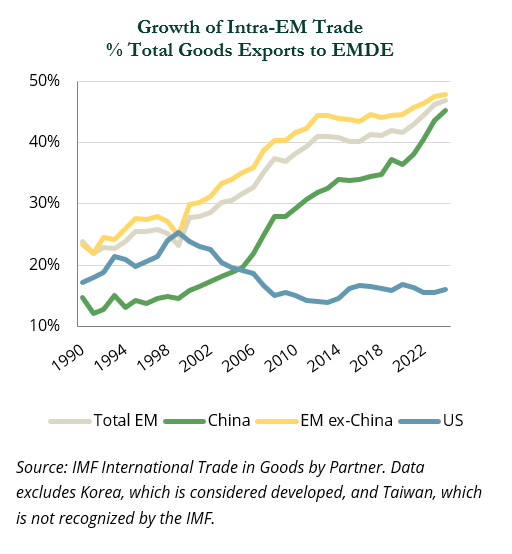

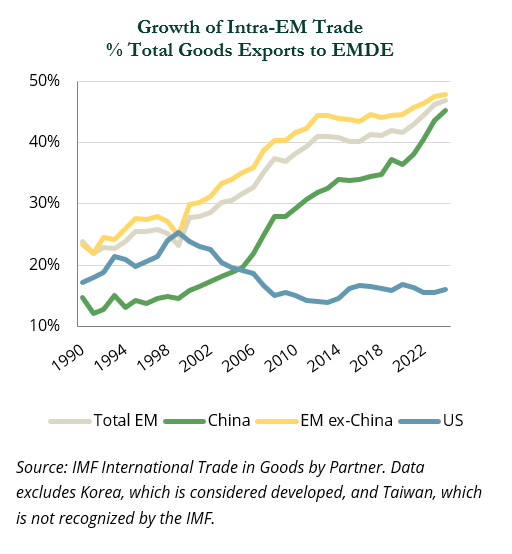

Emerging market trade routes and partnerships have reconfigured over the last three decades. While the U.S. remains a significant trading partner for many EM countries, the volume of trade among emerging and developing economies themselves has risen sharply and will likely continue.

This shift gained momentum during the first Trump administration’s trade war with China and accelerated further during the COVID-19 pandemic, when many emerging economies benefited from supply chain de-risking.

Emerging markets have also leaned into regionalism in the face of protectionism. As U.S. policies become more insular, new free trade agreements are stepping in to fill the void. A notable example is the anticipated ASEAN-Canada free trade agreement, expected to be finalized by the end of 2025. Such agreements can play a pivotal role in redirecting exports away from the U.S., potentially softening the blow of American tariffs.

The Rise of Domestic Consumption

The emerging markets growth story was historically defined by export-led industrialization. However, a broad shift toward domestic consumption is well underway across many EM countries, making these economies less reliant on external demand.

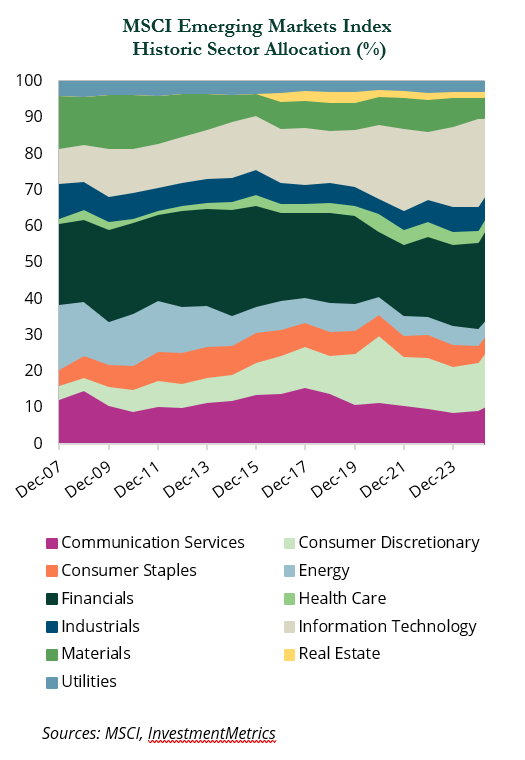

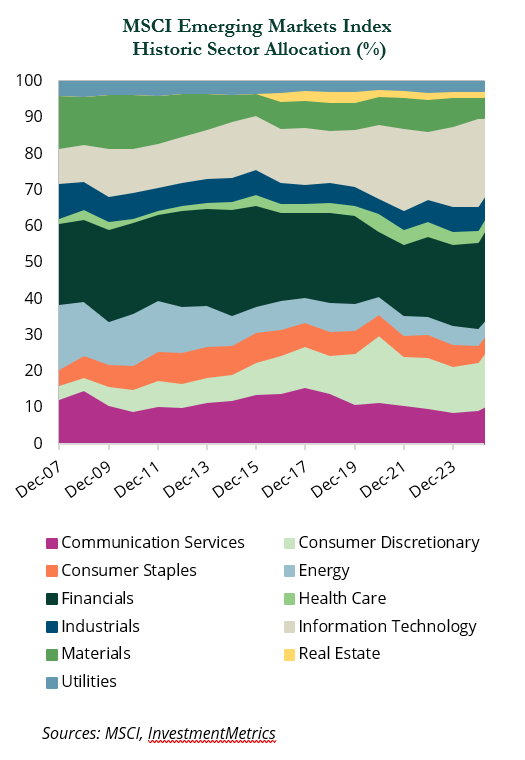

This shift is evident in the underlying sector composition of the MSCI Emerging Market Index. Historically dominated by commodity producers and manufacturing, the index is now more diversified towards high-tech and service-oriented sectors – such as e-commerce and fintech which are more focused on domestic demand and therefore presumably less susceptible to global trade disruption.

While some of this shift has been structural, policy-driven investments in strategic sectors have also provided a tailwind to diversification in recent years. China, for example, has invested heavily in building domestic capabilities in areas such as technology development and electric vehicle production, industries which align with broader goals of self-reliance and energy consumption.

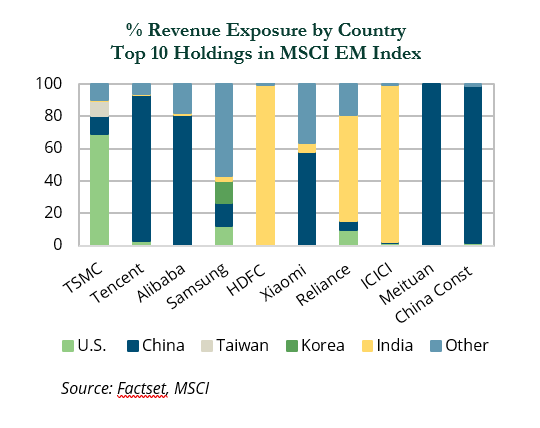

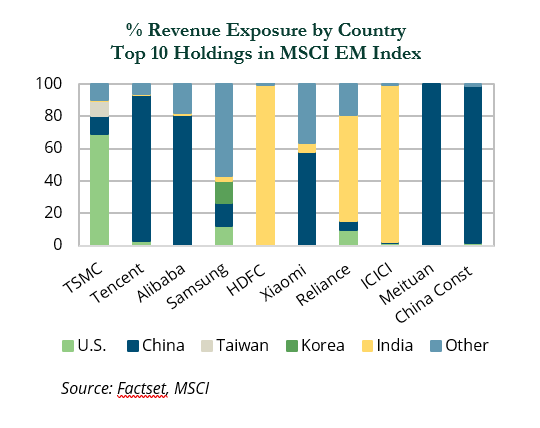

A review of geographic revenue exposure of the top ten benchmark constituents provides further evidence that emerging markets may be more insulated from global tariff policies than headline exposures indicate.

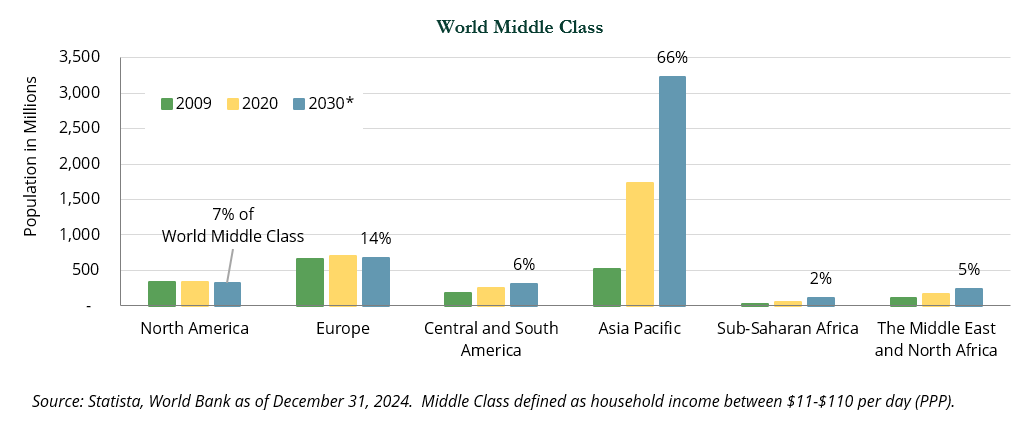

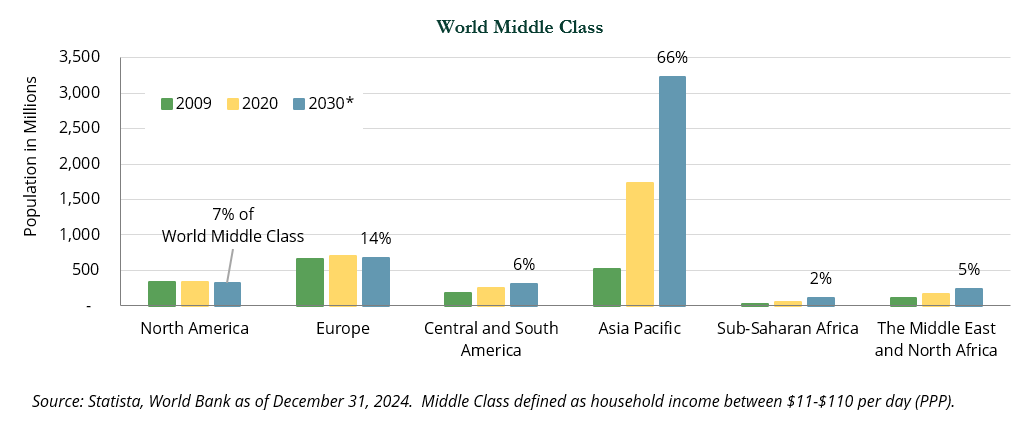

Favorable demographics and rising incomes, particularly an uptick in the size of the middle class, are expected to bolster this consumption trend. The Asia-Pacific region is on track to account for two-thirds of the global middle-class population by 2030, and such a massive consumer base may safeguard domestic consumption.

Policy Response Can Shape Resilience

Once viewed as fragile and reactive, many major EM nations have entered this period of trade turbulence with stronger policy frameworks relative to the past. Political regime changes and ongoing reform efforts have helped establish greater fiscal and monetary discipline, positioning many countries to better manage external shocks.

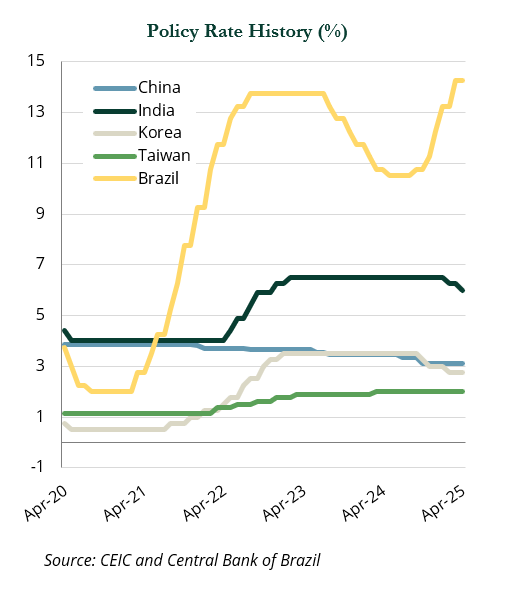

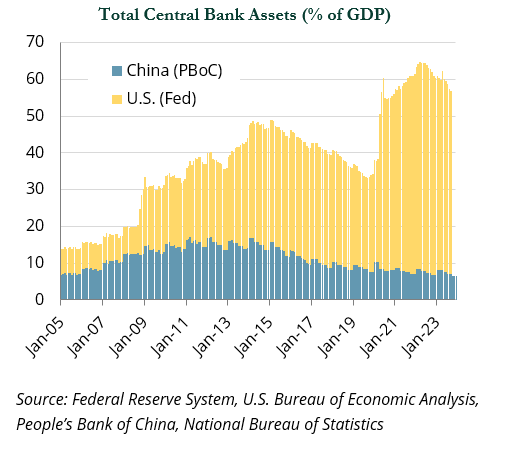

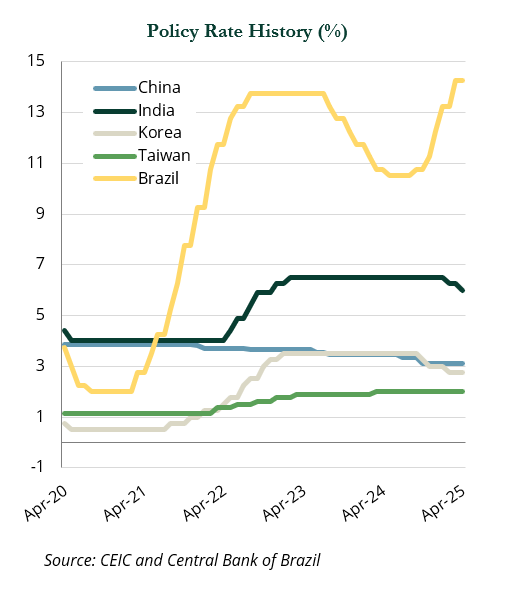

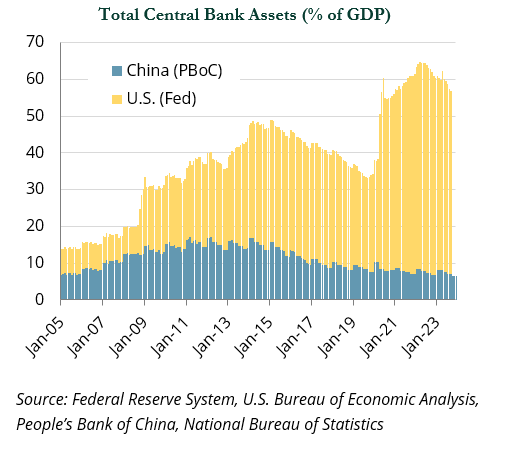

While economic conditions vary across markets, a number of EM countries have room to use such levers to potentially offset tariff risks. Central banks, many of which were early to raise interest rates in 2021 to combat global inflation, may loosen rates in an effort to stimulate both household and business spending. In parallel, liquidity injections may be used to support credit access and ensure functioning capital markets, especially if trade friction tightens financial conditions.

Fiscal tools are also likely to play a greater role. Targeted spending on infrastructure, for example, can not only offset a slowdown in trade activity but also create long-term economic benefits.

India has emerged as a standout example in this regard. The Modi government has committed to a massive increase in spending to target urban development and economic connectivity by modernizing key infrastructure, such as roads, railways, airports, and the power grid.

China successfully employed similar measures in the past, years before India, and the country now faces different challenges. China’s recent economic struggles have been discussed at length. Growth has been challenged in recent years; some of this was self-inflicted, such as by its COVID lockdown policy, but continued stress in the property sector also contributed. Beijing has thus far opted for incremental policy support rather than sweeping stimulus—a strategy that leaves room for more aggressive intervention if trade pressures intensify.

Supply Chain Complexity

Nearshoring trends drove increased capital investment into EM nations and deepened their presence in the global supply chain.

Southeast Asian countries such as Vietnam and Indonesia were notable beneficiaries, driven in part by low labor costs, proximity to major shipping routes, and relative political stability. These countries became key manufacturers of low-cost textiles and apparel, as well as electronic components such as smartphones.

Other tech-heavy emerging markets such as Taiwan and South Korea, which are home to high-end semiconductor and key memory suppliers, are also critical players in the global trade landscape.

As importance grew, so did the target on their back. New U.S. trade policy took aim at countries with large trade imbalances and emphasized efforts to reshore manufacturing back to the U.S.

Full-scale relocation of supply chains is complex and requires significant capital investment. While many global exporters such as leading semiconductor chip producer Taiwan Semiconductor have committed to increase capacity in the U.S., realignment with the new trade regime could take years if not decades. Emerging markets production capacity is likely to remain in place and continue to contribute to economic growth.

Conclusion

The introduction of sweeping tariffs by the U.S. government marks a significant development in the global trade architecture that presents interesting investment implications for EM economies.

While the potential second-order risks to global growth and inflation are material—particularly if reciprocal tariff policies remain—the investment implications for emerging markets are more nuanced. Far from being passive recipients of global economic pressure, many EMs have evolved in recent years into complex, diversified economies with expanding domestic consumption, improving policy regimes, and rising investment in high-growth sectors. Some emerging market countries are also poised to benefit from regional trade realignments and supply chain diversification efforts. For investors, this means emerging markets may in fact emerge as relative winners in a world of trade fragmentation.

As with an investment decision, diversification remains key. Emerging markets have grown to represent 10% of the global equity market and, in our view, is too large to ignore. Emerging markets investments will likely remain volatile in the face of rising protectionism, but we continue to recommend retaining exposure to the asset class, as its resilience is a trend worth watching. ■

Copyright MSCI 2025. Unpublished. All Rights Reserved. This information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an “as is” basis and the user of this information assumes the entire risk of any use it may make or permit to be made of this information. Neither MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information makes any express or implied warranties or representations with respect to such information or the results to be obtained by the use thereof, and MSCI, its affiliates and each such other person hereby expressly disclaim all warranties (including, without limitation, all warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information have any liability for any direct, indirect, special, incidental, punitive, consequential or any other damages (including, without limitation, lost profits) even if notified of, or if it might otherwise have anticipated, the possibility of such damages. Indices referenced are unmanaged and cannot be invested in directly. Index returns do not reflect any investment management fees or transaction expenses. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Some statements in this report that are not historical facts are forward-looking statements based on current expectations of future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results. © 2025 Prime Buchholz LLC