Perspectives

Investment Perspective: Private Foundations – Driving Innovation in the Nonprofit Community

Mar 15, 2024

Back to all postsSuccessful entrepreneurs are often described as persistent, unconventional, disruptive and innovative. The same can be said for one of the more influential members of the nonprofit community: the private foundation.

Like disruptive entrepreneurs, private foundations often view the world through an unconventional lens. They push boundaries and challenge consensus. Private foundations are responsible for drawing attention to some of our world’s most pressing issues and for funding countless break-through technologies. The James Webb Telescope, the Human Genome Project, Ebola and Malaria vaccines are among the thousands of ground-breaking discoveries encouraged and funded by private foundations.

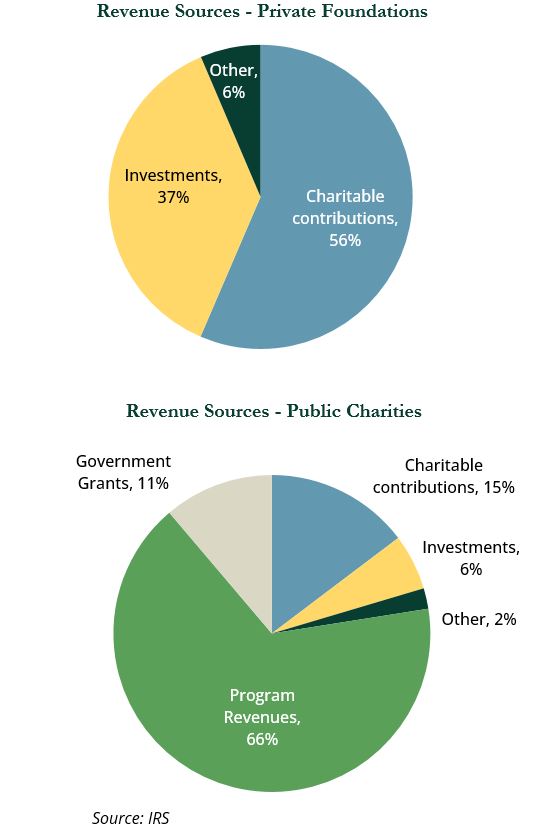

The outsized impact of private foundations is even more impressive when one considers the obstacles they face. Unlike public charities, private foundations have very few sources of income, typically relying largely on the generosity of a single donor and subsequent investment returns offered by investment portfolios. Therefore, operating budgets and grant-making depend entirely on the success and continuity of the investment program.

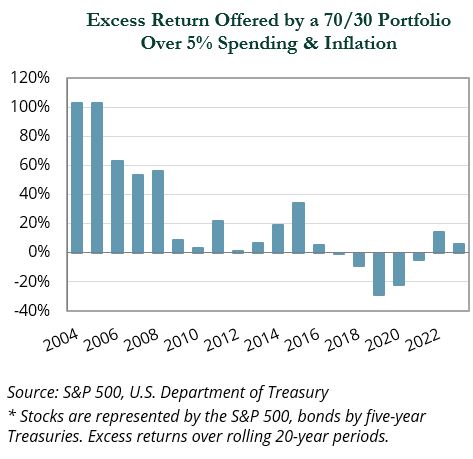

Considering these obstacles, it is not surprising that private foundations often face an uncertain future. Some estimates suggest roughly half of all private foundations face a slow crawl toward extinction as investment returns have been insufficient to offset higher inflation rates and a mandated 5% spending requirement.

However, proper investment management can improve the chances of survival of private foundations and ensure their contributions to our planet continue.

In this investment perspective, we share some of the unique obstacles and financial attributes of private foundations and discuss several strategies for addressing these challenges.

Unique Characteristics

Unique Characteristics

An Unconventional Attitude

The unorthodox and independent attitude of private foundations stems from a variety of factors. One of the most significant is the founders themselves, who, in many cases, created enormous personal wealth by challenging conventional thinking. Rockefeller, Ford, Gates, Bezos, and Zuckerberg are just some examples of disruptive personalities using their private foundations to find solutions to some of the world’s greatest challenges.

Another contributing factor to nonconformity is the unique obstacles that private foundations face. Although by no means disadvantaged, their relatively unfavorable treatment under federal tax law may contribute to this rebellious attitude.

Unlike many public charities, private foundations:

- Have no routine public support

- Do not have operating revenues like hospitals or educational organizations

- Are mandated to spend a portion of their assets every year

- Are taxed on their investment income

- Cannot offer the same favorable tax benefits for charitable contributions

Overcoming Obstacles

One might assume that these challenges limit the impact of private foundations. However, private foundations remain among the most influential members of the nonprofit community. Six of the 10 largest philanthropic organizations in the world are private foundations. They account for over $1 trillion in combined charitable assets and are our country’s single largest institutional source of philanthropy.

Their impact extends well beyond the assets they control. Private foundations have tackled and resolved some of the world’s most significant challenges and are the driving force behind many of our community foundations, educational institutions, and healthcare organizations.

Success Depends On Financial Stewardship

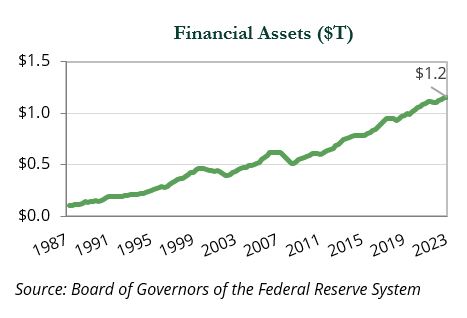

The fundamental anchor to the long-run success of a private foundation is the sustainability of the financial assets. Without assets to give, a private foundation ceases to exist. Most seek to survive into perpetuity, making routine and sustainable impact within and across future generations.

Their success—defined as infinite, consistent and sustained support for charitable causes—depends on a variety of factors, but the most fundamental is the donor’s original gift and subsequent returns offered by investment programs.

Unfortunately, a private foundation’s survival is far from certain. Virtually all, by nature of the mandated spending, lose some ground relative to their perpetual objectives, each year. More recent results suggest investment returns have generally failed to keep pace with the combination of spending, fees, and the eroding effect of inflation.

Private Foundations Routinely Outperformed

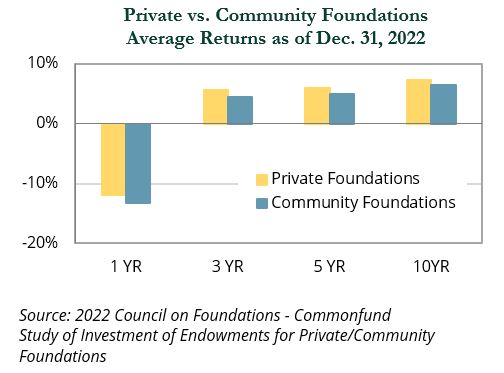

With the investment program a critical factor to the continuity of a private foundation, there is some optimism in historical investment results: Private foundations have typically outperformed their public charitable counterparts.

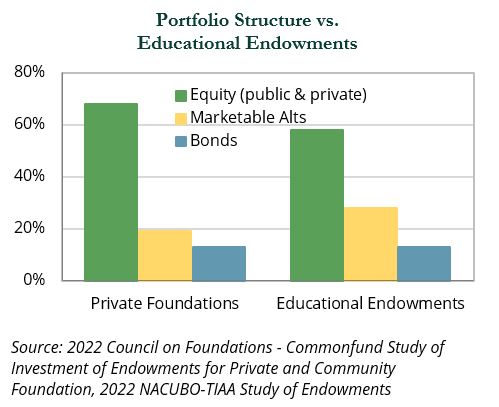

A variety of factors have contributed to the excess returns enjoyed by private foundations. Private foundations generally tend to invest more of their assets in the equity markets, and therefore, assume a higher level of return volatility than other investors. They also typically accept higher levels of liquidity risk in equities and other areas of the capital markets.

We caution against assuming higher volatility and liquidity risk automatically lead to long-run success. These factors need to be carefully considered in the context of the market environment at the time, and the unique spending path and liquidity needs of each individual private foundation. Also, while we believe asset allocation is the most important determinant of success, implementation matters.

The proper balance of active vs. passive strategies, the corresponding tracking error, appropriate rebalancing and spending techniques, manager selection skill, and application of fees and risk in the proper categories each present an opportunity to add value or, if implemented poorly, impair results.

Foundational asset allocation and implementation techniques remain critical factors, enabling private foundations to continue impacting the world and maintaining their influential status within the charitable community.

How We Serve Private Foundations

Within the comprehensive set of investment services, our private foundation clients often highlight the following as the most beneficial:

Private Markets Access

Private markets have made important contributions to the returns earned by the private foundation community. When it comes to private markets, however, some investors simply do not know where to start—or they believe their asset base is insufficient to participate.

Prime Buchholz offers comprehensive asset allocation and implementation advice across private markets, including in various sub-strategies (e.g., venture capital, buyout, infrastructure, real estate, and natural resources). Clients have access to a variety of planning and risk management tools to assist in the proper implementation and ongoing management of their private markets allocations.

Our deep team of experienced research professionals offer a differentiated approach to assessing and accessing compelling investment ideas. Our comprehensive tools—including our proprietary analytics and reporting platform, PrimePlus®—and full retainer approach are available to all clients, regardless of type and size.

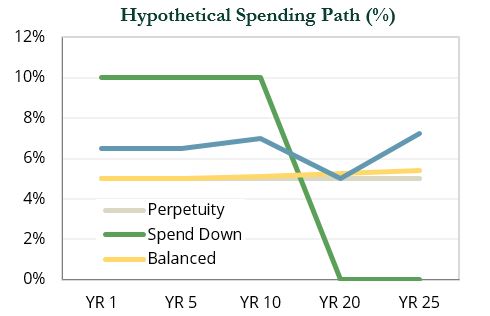

Spending Methodology Assessment

Many private foundations simply meet the minimum required distribution each year, which is a perfectly acceptable method. However, others vary their spending methodology depending on time horizon, risk tolerance, and charitable intent—there is no “one size fits all” solution.

What is most important is that the spending methodology adopted suits the private foundation’s unique needs and interests. Using different analytical tools and decades of experience, we help private foundations consider a variety of spending methodologies and identify the version most consistent with their objectives.

Fee Conservation

Every dollar a private foundation spends on investment management fees is a dollar less contributed to important charitable causes—perhaps more, when compounded over time. We are conscious of the burden that fees can have on an investment program and seek to implement higher fee strategies only when we believe there is a high potential of excess returns, such as in the private markets. We offer underlying fee transparency to our clients in the form of a comprehensive fee assessment and, whenever possible, seek to negotiate fees in favor of our collective client base.

Concluding Thoughts

Private foundations embody the spirit of disruptive innovation, applying an unorthodox lens to address global challenges and drive significant advancements.

Despite facing unique financial and regulatory hurdles, their enduring impact across various sectors underscores the vital role they play in philanthropy. Their success hinges on strategic financial management and adaptability, ensuring their continued contribution to societal progress.

Prime Buchholz is uniquely positioned to help private foundations customize their approaches to adapt to their specific needs, challenges, and opportunities. Please reach out to info@primebuchholz.com to learn more. ⬛

THOMAS P. LUPONE

THOMAS P. LUPONE

Principal/Sr. Consultant

Indices referenced are unmanaged and cannot be invested in directly. Index returns do not reflect any investment management fees or transaction expenses. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Some statements in this report that are not historical facts are forward-looking statements based on current expectations of future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results.© 2024 Prime Buchholz LLC