Introduction

Even as we have witnessed momentum among our clients to identify and invest with diverse managers, the asset management industry has been slow to address a history of gender and racial homogeneity. Recent events have put a spotlight on a number of industries where the immense benefits of a diversity of perspective and experience have yet to be realized.

While more progress is needed, there are signs of positive change throughout corporate America, spanning various industries and sectors. A 2019 McKinsey & Company study showed a 24% increase in C-suite women and minority executives from 2015 to 2019[1]. Efforts to embrace diversity and promote inclusion have been aided by numerous studies showing companies with women and minorities in leadership positions outperform those that do not.

Despite growing awareness, the asset management industry remains woefully behind other industries, as action has lagged assurances.

In this report, we provide an overview of the state of diversity in the investment industry. We also share some of the tools and approaches available to investors seeking to increase or influence the diversity of the investment managers and holdings in their portfolios.

Women & Minority Representation

Despite similar performance results, women and/or minority-owned firms represent approximately 1% of the $70+ trillion asset management industry, according to the 2019 report, Diverse Asset Management Firm Assessment[2].

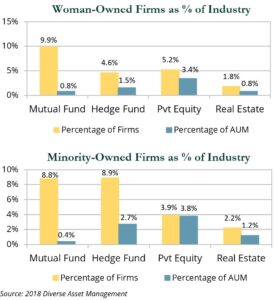

The report revealed significant challenges facing women and minorities in the investment industry. By structure firms managing mutual funds―primarily equity and fixed income strategies―had the most meaningful representation of women and minority ownership. Across the mutual fund universe, 9.9% of managers had meaningful woman ownership and 8.8% meaningful minority ownership. However, in each subcategory, the percentage of assets managed by diverse firms was far less than the percentage of firms they represented. For example, while 8–9% of firms were diversely owned, the total assets they managed represented less than 1% of industry assets.

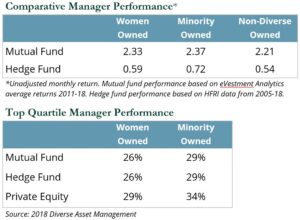

The study also found no statistical difference between the performance of diverse managers and their peers. In fact, the survey concluded that in many instances diverse managers outperformed their non-diverse peers.

Likewise, at the company level, several studies have shown companies with diverse leadership perform better than those without. McKinsey & Company discovered companies in the top-quartile for gender diversity at the executive level were 21% more likely to have above-average profitability than those in the fourth quartile. For ethnic/cultural diversity, top-quartile companies were 33% more likely to outperform on profitability[3].

An October 2019 S&P Global study found firms with women CEOs and CFOs produced superior stock price performance compared to the market average. Women CEOs saw a 20% increase in stock price momentum and women CFOs saw a 6% increase in profitability and 8% larger stock returns[4].

Institutional Implementation

Only 4% of the 802 colleges/universities that responded to the 2018 NACUBO-TIAA Study of Endowments indicated they have a policy for hiring investment managers that meet diversity and inclusion criteria.

On the foundation side, 10% of private foundations and 8% of community foundations stated they seek to invest with diverse managers, according to the 2018 Council on Foundations – Commonfund Study of Investment of Endowment for Private and Community Foundations. The survey also showed that while 20% of private foundations and 37% of community foundations have discussed adding diverse managers to their portfolios, only 13% and 12%, respectively, have actually considered adding them to their portfolios.

In our experience working with clients, a variety of challenges can stand in the way of organizations making meaningful progress. In addition to different definitions of diversity and levels of materiality, there is a lack transparency or consistency in the data on diversity provided by investment firms. Firms domiciled in Europe or the U.K. cannot collect or share data on the diversity of their workforces. Add confusing terminology and a growing and complex landscape of options and it is easy to see where well-intended committees and boards become immobilized. Despite the challenges, we have seen a sharp increase in clients seeking diverse investment managers in their portfolios.

These clients include:

- An HBCU (Historically Black Colleges & Universities) that has opportunistically invested with firms and strategies led by African Americans and holds other managers accountable for diversity and inclusion.

- A foundation client that has committed to a 100% level of woman- and minority-owned, led and impact investments.

- A private foundation that has committed to a portfolio that is managed by a group of diverse managers that reflect the demographics of communities they support.

We expect these numbers to rise in 2020 as investors, committees, and donors make additional strides to align their portfolios with their values.

Considerations

The lens through which diversity is viewed is integral to developing a representative investment program. While some may define a “diverse” investment manager as one with women or minority ownership, others may give more weight to firms with diverse decision makers. In our annual survey of investment managers, we inquire about diversity policies and initiatives to enhance diversity at the firm and in our industry.

Advances will require a commitment from the industry, and we are looking for firms that have policies and programs in place that will bring meaningful change.

Another important layer of consideration is the impact of the investments. Investors may consider strategies that favor women- and minority-led companies or those that invest in underrepresented communities.

How We Can Help

Prime Buchholz partners with clients to build comprehensive customized solutions. We have found our five-step approach to mission alignment instrumental in providing clients a way forward through the uncertainty and complexity.

-

Know What You Own

Annually we perform a comprehensive survey of our recommended managers to understand, document and evaluate their approaches to diversity, equity and inclusion.

-

Bring Everyone to the Table

A typical next step is to engage with staff, boards, family members, trustees, committees, donors, and/or community members to gain commonality in definitions and materiality.

-

Find Like-Minded Partners

The space and solutions are evolving in real time. In order to support our clients we have sought to leverage the resources of a variety of organizations, partners, and clients that are focused on expanding opportunities for diverse managers and communities.

-

Align Your Portfolio

Prime Buchholz actively engages managers at the outset of our due diligence and actively monitors any developments to understand how diversity and inclusion is considered at the firm and in the investment process. We maintain a vetted list of investment managers with diverse ownership, management, and portfolio managers. As of year-end 2019, we recommended 275 products offered by 84 different managers with at least 25% women or minority ownership. We also recommend a number of investments that positively impact communities of color and support diverse entrepreneurs. We are committed to growing the list of opportunities available to clients committed to diversity in their investment portfolios.

-

Make an Action Plan and Act

With guidance from stakeholders, and within the agreed policy allocations and approach to implementation, we will work to enhance diversity across the portfolio’s investments. Our exposure reports detail ownership, management, and decision-making, as well as qualitative detail on the initiatives in place at each firm and in each investment strategy to promote diversity, equity, and inclusion.

The implementation plan is informed by both our investment philosophy and the range of products available. We often recommend a staged approach focusing on each asset class, beginning with the asset classes with the most robust universes, such as public equities and fixed income.

We use broad market benchmarks to evaluate performance of individual strategies and are familiar with strategies promoting diversity that have historically outperformed broad indices over distinct periods.

For clients seeking diversity in their investment portfolios, we look forward to actively partnering and engaging with you on your diversity, equity and inclusion initiatives. Please do not hesitate to reach out to your client service team to learn more.